Run your payroll from any computer with an internet connection. Let your employees record their hours on the go with our mobile software.

Reliable & Affordable Payroll Service

Our intermediary service means that we will take care of your payroll and you can concentrate on other areas, saving you from costly mistakes.

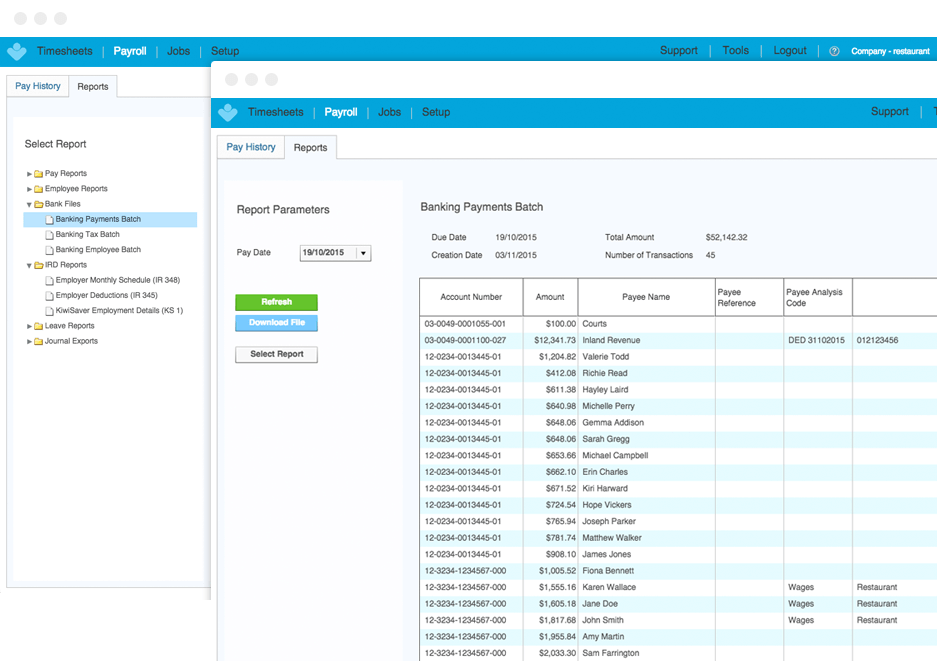

We have partnered with Flexitime to offer their online payroll and employee time management system to our clients as part of our packages.

Looked at most of the payroll systems and software on the market in New Zealand we chose Flexitime because it’s simple to use, has great functionality and integrates seamlessly with Xero.

Flexitime is a Xero add on, this means the system has been designed to integrate seamlessly with your business accounting on Xero to provide accurate and up to date information without needing to transfer or re-enter information in separate systems.

Payslip creation based on Timesheets/Salary

Calculating pay and deductions

Automatic emailing of payslips to staff

Ability to create flexible, integrated rosters and timesheets

Secure cloud-based system

Seamless integration with Xero

Comprehensive reporting

Commission based pay and invoicing

Transferring payments to staff and IR

Comprehensive reporting

Filing and payment of IR returns

Communicating with IRD on your behalf

Flexipayroll is the best solution

Don’t hesitate to ask us something. Email us directly admin@flexipayroll.co.nz or call us at 0800 88 70 70.

You can check out our FAQ and About Us page to get more information about our products.

0800 88 70 70

AVAILABLE AT 9:30AM - 5:30PM